By Bazil Masabo

Human Biotechnology and TechBio

Health biotechnology plays a crucial role globally driving advancements in vaccine development, precision medicine, regenerative therapies, and diagnostic tools to tackle global health challenges. The rapid development of COVID-19 mRNA vaccines, for example, highlighted biotech’s ability to respond swiftly to global health emergencies. Biotech provides tools for tackling chronic diseases, genetic disorders, and advancing personalized medicine.

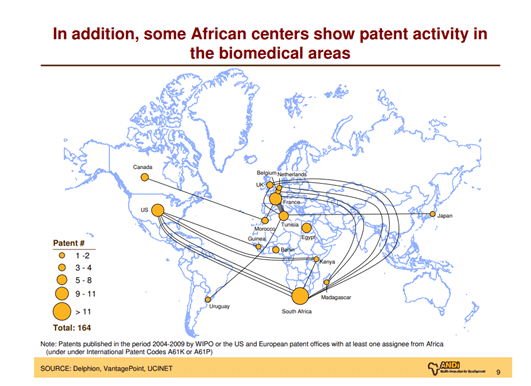

In Africa, health biotechnology has demonstrated the potential to address the continent’s unique healthcare challenges, such as infectious diseases (HIV, malaria, tuberculosis), neglected tropical diseases, and maternal health. African countries, notably South Africa, Kenya, Egypt, and Nigeria, are making significant strides in developing biotech innovations and enhancing capabilities in local vaccine production, diagnostics, and genomics research.

Biotechnology is a life sciences discipline that focuses on leveraging biological systems and organisms to create products and technologies to solve problems. Traditional biotech employs the science-first approach in problem solving that relies on wet-lab experiments, animal models and clinical trials to validate hypotheses and products. Over the years, biological research especially in the areas of genomics, proteomics, cell biology and molecular biology has created vast amounts of biological data.

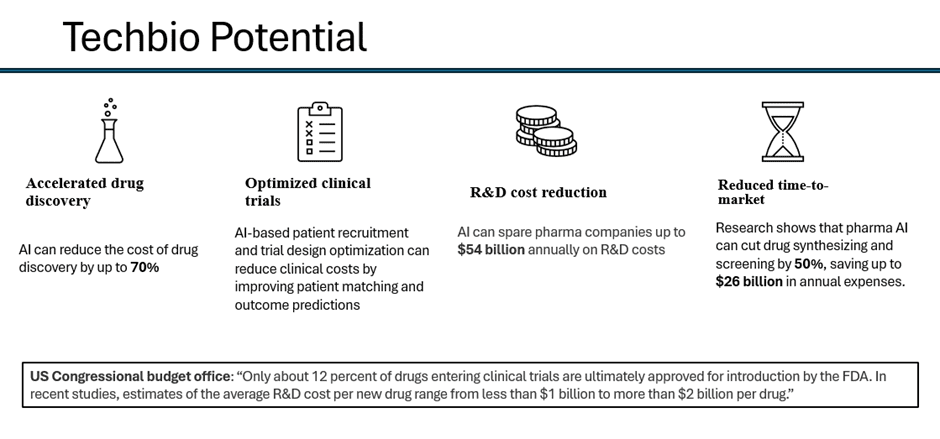

Techbio leverages technological advancements like AI, ML and big data analytics to make sense of these huge amounts of digital biology datasets in a humanly impossible pace. As a computational flipside of biotech, it enables accelerated discoveries, improved drug design, reduced research costs and provides more precise and personalized healthcare solutions. With reported drug and development R&D costs in excess of $2 billion and only 12% of drugs making it through clinical trial to approval, techbio offers a great promise.

Global Market summary

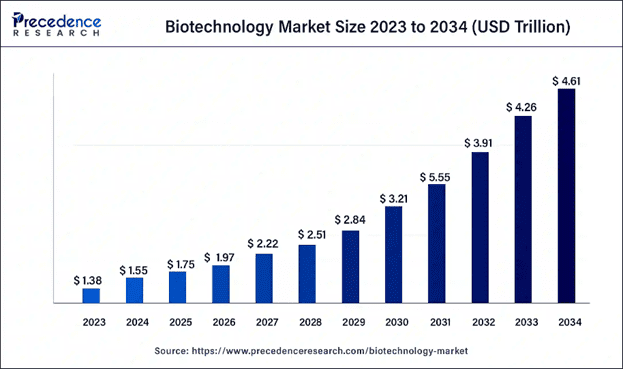

The global biotech market is growing and is estimated to exceed the $5 trillion mark by 2031. There is a high number of innovations and with significantly high exits in mergers and acquisitions. The high investment needs present a significantly uncrowded competitive landscape. Additionally, the high risk associated with extensive research, huge clinical trials, long to market timelines and stringent regulatory approvals presents a hindrance to the entrance of alternatives.

Bio-pharma commands a large share of the market (41.73%) leading out consistently since 2020. Tissue engineering and regeneration, DNA sequencing and cell-based assay are among the technologies leading out front.

North America and Europe

North America and Europe command a combined 65% share of the market driven by extensive R&D, a strong presence of biotech companies, high healthcare spending, and significant adoption of advanced technologies such as genomics and biopharmaceuticals.

Asia-Pacific

The Asia-Pacific region is the fastest-growing in the global biotechnology market, driven by increasing investments, improvements in healthcare infrastructure, and government initiatives. Countries such as China, India, South Korea, and Japan are leading the growth fueled by the rising demand for health biotechnological solutions and adoption of advanced recombinant therapeutics, vaccines, and gene editing technologies.

Africa

The African Biotech market is still nascent but rapidly growing and expanding across healthcare, agriculture & environmental sectors but still concentrated heavily in healthcare. The biotech industry in Africa valued at $26.28 billion is projected to grow at a CAGR of 8.99% through 2030. The Middle East and Africa region commands 2-5% global market share and is experiencing significant growth due to a rising healthcare demand, an increasing purchasing power, a focus on addressing chronic diseases, and government investment in infrastructure.

Saudi Arabia’s pharmaceutical market, the largest in the middle east, is expanding with investments in biotech, genomics, and personalized medicine. The UAE is positioning itself as a hub for innovation with initiatives like the Emirati Genome Program and investments in biotechnology parks and research.

In Africa, Egypt has been a large-scale manufacturing investment due to its developed industrial base. South Africa dominates the African Biotech market due to its large life sciences ($3.2 billion) and healthcare market ($28.1 billion) and significant pool of world-class researchers and academic institutions.

Drivers of African Biotech

Rising burden of chronic diseases

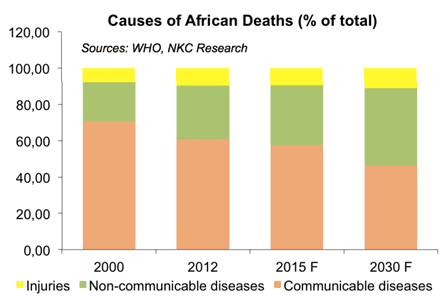

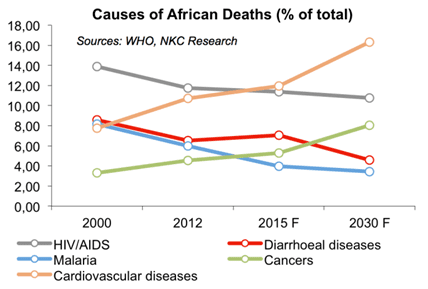

The burden of NCDs such as diabetes, cardiovascular diseases and cancers is increasing rapidly in Africa. According to the WHO, communicable diseases accounted for some 70.7% of all deaths in Africa in 2000, 60.7% in 2012, and projected to only account for some 46.4% of all African deaths by 2030.

On the other hand, NCDs are projected to rise considerably, with the number of mortalities related to cardiovascular diseases forecast to outnumber deaths from complications due to HIV/AIDS by 2030. Consequently, the manner in which healthcare and life science is approached in Africa needs to adapt to the changing mortality demographics of the continent.

Primary reforms that need to be addressed for Africa to update its healthcare system include the shift to preventative care, as opposed to the current status quo of reactive care; improved healthcare access via mobile telecommunications penetration; tightened regulations pertaining to counterfeit medicines, care of medical devices, and pharmaceutical distribution; as well as expansion of healthcare insurance and coverage.

These changes, driven by urbanization, lifestyle changes and longer life expectancies are pushing innovations in the areas of precision medicine, diagnostics and biopharmaceuticals. Genomics is gaining traction in the continent to develop more targeted treatments and supply the demand for personalized medicine.

Ongoing infectious diseases

Africa is still plagued by persistent infectious diseases like Malaria, TB and HIV/AIDS. Over 90% of global malaria cases are in Africa despite the concerted efforts towards eradication. Innovations in vaccine development, diagnostic tools and drug manufacturing are helping to combat these diseases. There is an increasing focus on developing new therapies using biotech like monoclonal antibodies for Ebola.

Climate change and rapid urbanization are contributing to the emerging pandemics and epidemics. To build health safety in the continent, biotech and life sciences researchers and players are focusing on rapid diagnostics, disease surveillance tools and vaccine platforms that can rapidly adapt to new pathogens.

Maternal and child health

The high maternal and child mortality rates in Africa are pushing for biotech interventions for better outcomes. While the lifetime risk of dying from pregnancy-related complications is 1 in 4,700 in the industrialized world, the lifetime risk of an African woman dying from pregnancy related complications is 1 in 39. Children continue to face different chances of survival based on where they are born, with sub-Saharan Africa and southern and central Asia bearing the heaviest burden for newborn deaths. Sub-Saharan Africa had the highest neonatal mortality rate in 2022 at 27 deaths per 1000 live births, followed by central and southern Asia with 21 deaths per 1000 live births.

Portable ultrasounds are improving access to pregnancy care for women in rural areas combined with mobile health platforms that offer education on pregnancy. Wearable sensors, low-cost diagnostics and telemedicine are among other areas of focus.

Africa’s vast biological diversity

Africa is home to the most genetically diverse populations in the world, which offers unique opportunities for biotechnology, particularly in genomics and precision medicine. African genetic diversity allows researchers to explore disease mechanisms that are underrepresented in global health research, providing insights into conditions like hypertension, diabetes, and infectious diseases.

However, the rich and diverse genomics of African populations is significantly underrepresented in reference and in disease-associated databases. More than two decades after the completion of the Human genome project, still less than 2% of human genomes analysed so far have been those of African people1, even though Africa contains more genetic diversity than any other continent. Too little of the knowledge and applications from genomics have benefited the global south because of inequalities in health-care systems, a small local research workforce and lack of funding.

The rich flora and fauna species in Africa offers a treasure trove of compounds for modern drug development. Investigations into pharmacological properties are seeking to discover bioactive compounds from plants commonly used in traditional medicine. Most of these rich African biological treasures have been harvested for value addition and processing outside of Africa. However, in recent times, African biotech players are reversing the tide.

The Push for Local manufacturing

Pharmaceutical manufacturing on the continent dates to as early as 1897, for Senegal’s Institut Pasteur de Dakar, and 1896 for Egypt, on establishment of a state laboratory that is now Vacsera. Between 1896 and 1933, North Africa dominated establishment of local pharmaceutical firms before activity then spread to southern and West Africa. Many sub-Saharan African countries saw a wave of new investment in pharmaceutical production after independence, in the 1960s and 1970s, which aimed to serve the primary health sectors and hospital expansion instituted by independent governments.

Africa has for a long time been heavily reliant on importation of goods. The continent imports more than 80% of its medical consumables, 70-90% of the drugs it consumes and 98% of vaccines used. COVID-19 exposed the danger of reliance on global supply chains and increased awareness that Africa needs to produce its own medical goods. Already efforts are underway to establish a vibrant local manufacturing to meet the health demands of the continent. In 2020, Africa’s pharma trade deficit was estimated at $7.1 billion showing a huge opportunity for investment in local manufacturing which could help reduce reliance on imports, create jobs, and lower costs for essential medicines.

Africa’s Biopharma industry

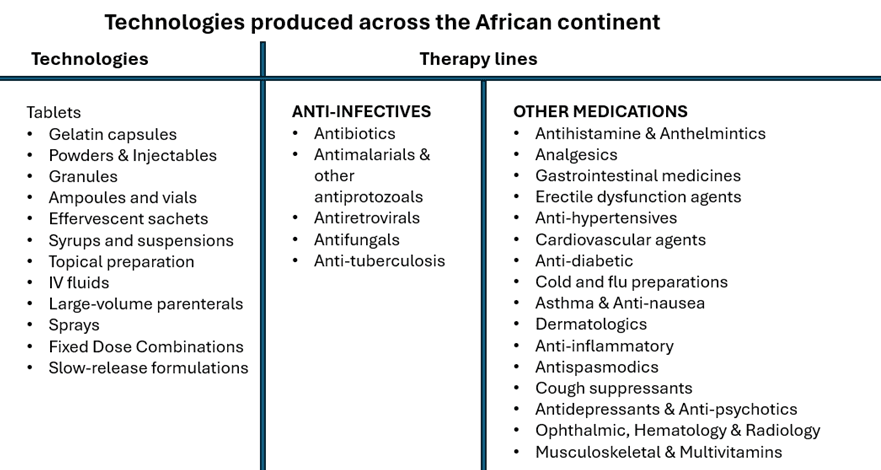

The local drug industry on the continent is characterized by generics manufacturers. The bulk of business models on the African continent are based on the generic-drug business model, which is premised on low-value products and therefore requires a low-cost base for competitive success and business sustainability. A major share of technologies and therapy lines produced within the continent covers bacterial, fungal and viral infections, reflective of the prevalence of infectious disease.

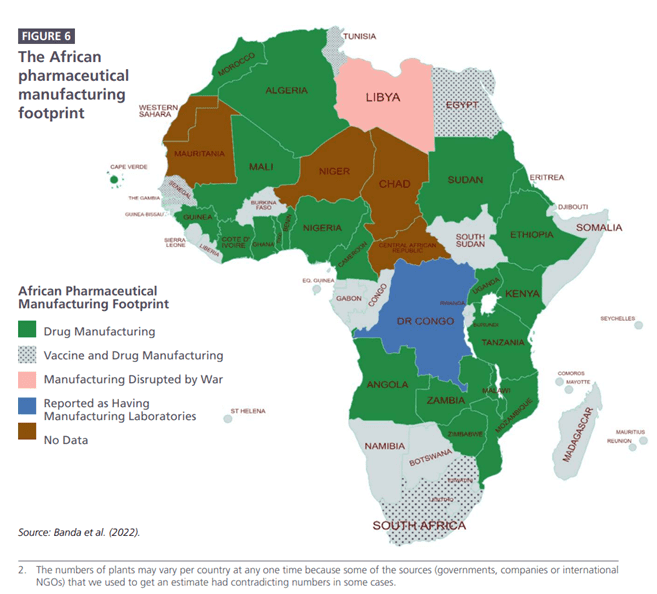

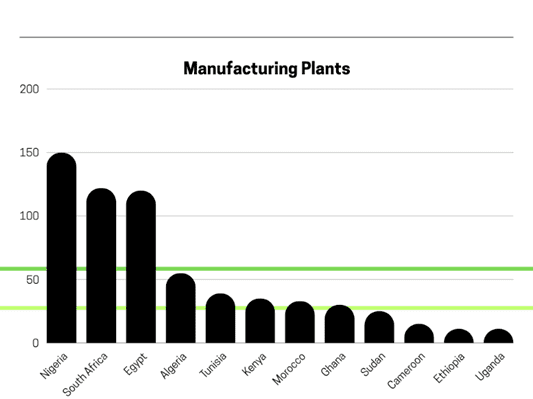

Africa has at least 649 pharmaceutical manufacturing plants across 29 countries with varying national capabilities. North Africa has the largest share at 272, followed by West Africa, which has 178 plants; southern Africa has 139 plants, and East Africa has at least 60 manufacturing plants. India and China, with populations comparable to Africa, have 5,000 and 10,500 pharma manufacturers respectively demonstrating a huge gap that is yet to be explored to meet the local demand for health products in Africa.

Regional hubs for Pharma production

Ghana and Nigeria for West Africa, and Kenya in East Africa, with Ethiopia and Uganda as key players. South Africa is the main hub for southern Africa, with Zimbabwe having been a key player in the past. North Africa shows a vibrant sector. In terms of numbers of plants, Egypt ranks first. North Africa outranks all regions on number and complexity of formulations and technological capabilities. The local industry in North Africa has leveraged joint ventures to facilitate technology transfer and move upstream in terms of drugs and biologics.

Continental & Regional policies supporting local manufacturing

There are several ongoing initiatives at supranational level to support local manufacturing. African leaders have pledged to increase the share of vaccines, medicines, and diagnostics locally manufactured in Africa to 60% by 2040. This vision will be achieved by establishing a sustainable vaccine development and manufacturing ecosystem underpinned by research and development, intellectual property (IP) and technology transfer, robust regulatory systems, innovative and sustainable financing, strategic partnerships, and commitment by African and global procurement agencies to purchase vaccines produced on the continent (Africa CDC).

What’s next?

Now that we’ve had an overview of the African biotech market and the drivers promoting the growth of the industry, in the next articles, we’ll explore the challenges inhibiting the growth of the industry, opportunities and future trends and an deeper analysis of the key stakeholders within the ecosystem and what they are doing. We would also like to interact and hear more from you on what more information you would like to know about the Biotech industry.